This week all eyes are, on the U.S. Inflation report as it takes the spotlight in the world. Its expected to steal attention from the beginning of the quarter corporate earnings season various Treasury debt auctions and possible updates in the presidential election race. Market watchers and analysts are eagerly awaiting Thursdays release of the June consumer price index (CPI) figures, which could greatly impact stock market movements and play a role, in shaping the Federal Reserves choices regarding interest rates.

The Federal Reserve’s Balancing Act

The decision to lower interest rates by the Federal Reserve may depend on the Consumer Price Index (CPI) data. If inflation does not increase much as anticipated Fed Chair Jerome Powell could indicate a rate cut during the September meeting. Certain analysts suggest that if the inflation data is significantly low a rate cut might even be considered in the coming weeks although traders, in the futures market view this as improbable.

On the side a higher inflation rate, than anticipated could put a stop to the trend in the stock market. Experts such as Tom Lee from Fundstrat and Neil Dutta from Renaissance Macro are warning that Wall Street might not be fully considering the possibility of a rate cut at the July meeting of the Federal Reserve. It’s important to take note of their perspectives given their history of making predictions that go against the norm, in both markets and the economy.

“If we see another reading there’s a chance that the Fed might decide to cut rates at their July meeting ” mentioned Lee. Dutta expressed views indicating that there is an undervaluing of the likelihood of a rate cut happening in July.

Market Reactions and Potential Winners

If the Consumer Price Index (CPI) data indicates a than anticipated rise it is likely that both stocks and bonds will experience an upsurge with Treasury yields maintaining their downward trend. Historically the release of CPI data has sparked reactions, in the stock market particularly following the Federal Reserves decision to raise interest rates at the start of 2022. While the intensity of these fluctuations has diminished as inflation has slowed down any indication of a rate reduction could provide a boost to struggling sectors such as small cap stocks and real estate.

Real estate has been the performer among the 11 sectors in the S&P 500 index over the year and the Russell 2000 small cap index has recorded slight declines since early 2024. According to Joseph Gaffoglio, who serves as president at Mutual of America Capital Management a rate cut by the Federal Reserve could act as a catalyst, for a market recovery particularly benefiting these sectors.

If you’re thinking about taking advantage of market changes you might want to check out real estate investment trusts (REITs) and small cap ETFs. These options could see returns if the Federal Reserve hints at lowering interest rates. You could look into putting your money in Vanguard Real Estate ETF (VNQ) to get into estate or iShares Russell 2000 ETF (IWM) for small cap investments.

Economic Indicators and the Fed’s Next Move

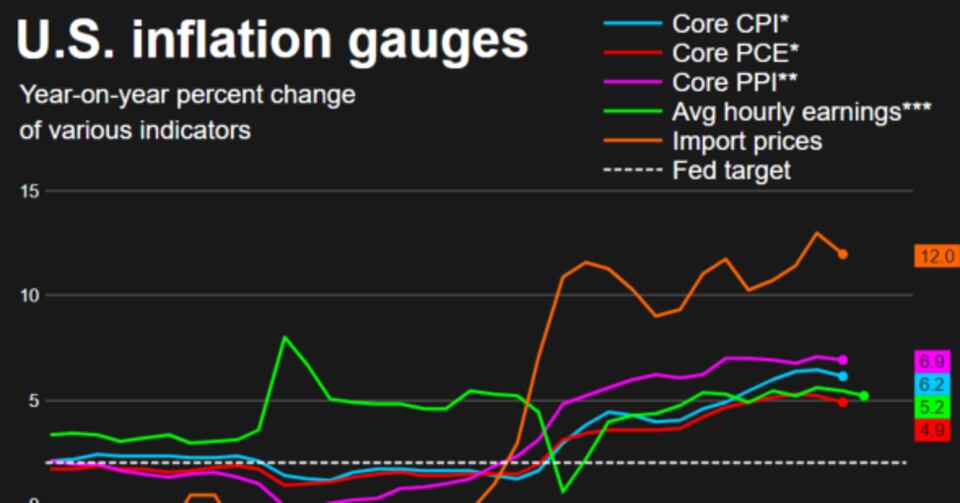

Economists surveyed by The Wall Street Journal predict that the rate of headline inflation will decrease to 3.1% year, over year in June from 3.3% in May while core inflation is expected to stay stable at 3.4%. Recent job data, indicating a slowdown in the labor market supports Duttas argument for the Federal Reserve to take action in reducing interest rates.

In June the unemployment rate rose to its level since 2021 and wage growth, a reliable indicator of inflation slowed down. Even though than 200,000 new jobs were added, revisions, to months data led to a net loss of 111,000 jobs overall affecting the three month average negatively.

This coincides with information showing that the economy is decelerating due, to the burden of record interest rates. The GDP growth rate in the quarter was 1.4%. A current indicator from the Atlanta Federal Reserve predicts a 1.5% growth rate for the second quarter a decrease from 3.4%, in the last quarter of the prior year.

Dutta cautions that “GDP growth is definitely slowing down. There’s a concern now that the Federal Reserve has kept interest rates high for long.” However some people have an interpretation of the labor market report suggesting that the increase in unemployment is because more people are entering the job market not due, to widespread layoffs.

Market Outlook and Investment Strategies

Fed Chair Powell recently stated that concerns, about inflation this year have subsided, indicating a shift towards inflation levels in the U.S. Economy. He mentioned that reaching the Feds 2% inflation target might be delayed until 2025 or 2026. There is a split within the Fed regarding the evidence of decreasing inflation before taking any actions with some officials monitoring signs of a potential economic slowdown.

Stocks closed higher Friday amidst speculation, among traders that upcoming data could lead to a Federal Reserve interest rate cut in September. The S&P 500 reached a high of 5,567.19 after gaining 30.17 points (0.5%). The Nasdaq Composite also hit a record by rising 164.46 points (0.9%) to reach 18,352.76 while the Dow Jones Industrial Average increased by 67.87 points (0.2%) to close at 39,375.87.